The Exit Lie: Why 74% of Owners Will Regret Their Sale

(And How to Make Sure You’re in the 26% Who Don’t)

The Lie Every Founder Buys Into:

“When I’m ready to sell… I will.”

“I’ll know when the time is right.”

“Someone will make me an offer I can’t refuse.”

Sounds logical, right?

But here’s what the data says:

- 74% of business owners regret how they exited their company.

- Only 2% have a written transition plan.

- 58% have done zero exit preparation.

They waited too long.

They weren’t ready.

And the deal dictated their destiny—not the other way around.

Why It Happens:

Most owners spend decades working in their business.

But never stop to work on the exit from their business.

So when the time comes? They:

Accept the first decent offer

Sell under pressure (health, partner, burnout)

Leave money on the table

Lose control of what happens next

And worst of all…

They realize after the wire hits:

“Shoot. I could’ve done this so much better.”

The Reality No One Tells You:

A great exit doesn’t happen when you’re ready.

It happens when your business is ready.

That takes time. Strategy. And a lot more than just revenue growth.

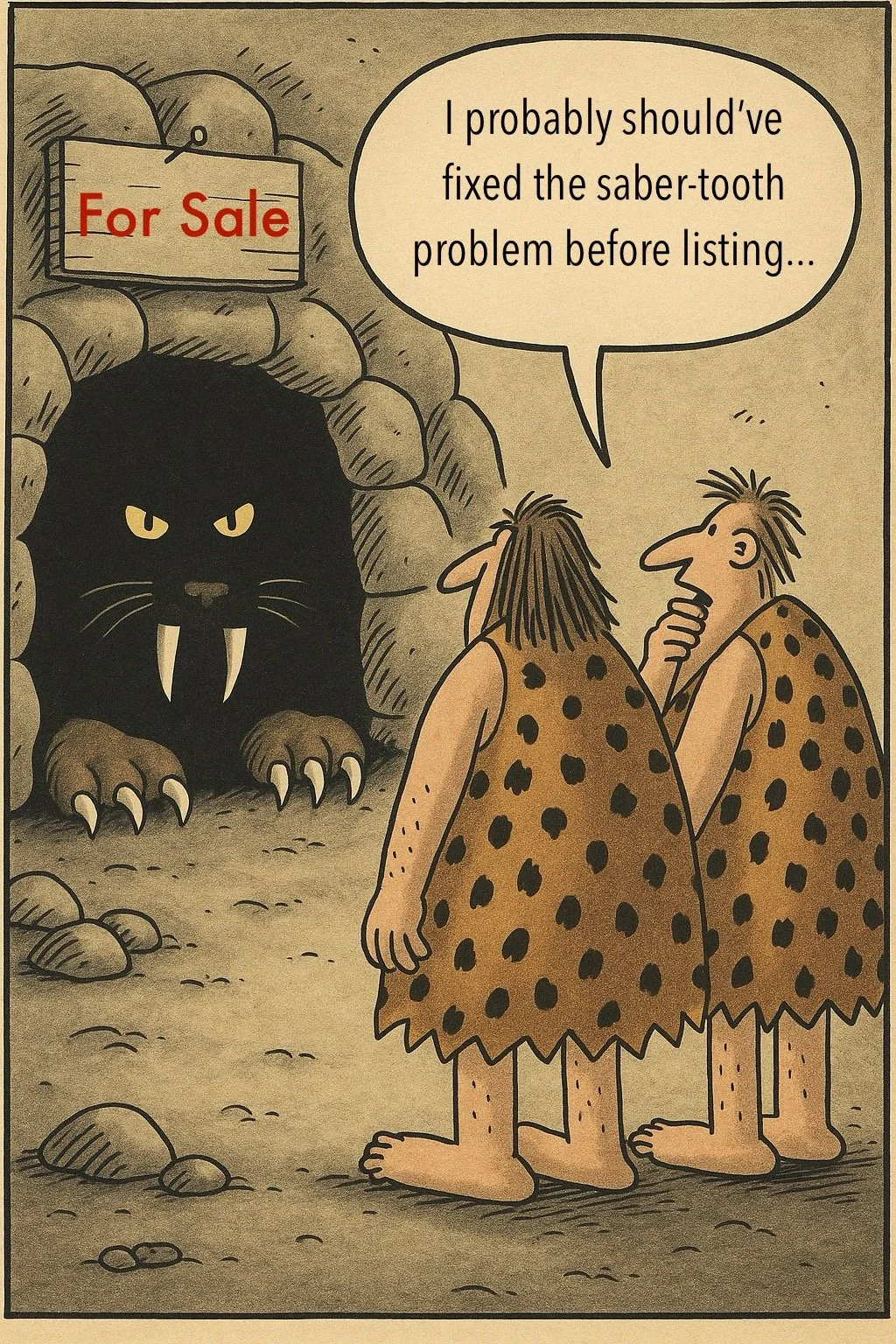

Most founders list their business before they’ve fixed the glaring issues. Guess what? Buyers notice.

The Owners Who Win? They Do 3 Things:

1. They De-Risk the Business

They remove founder dependency, build a leadership team, and create a business that runs without them.

2. They Engineer Value Beyond EBITDA

They focus on the multiple—by maximizing intangible capital (human, customer, structural, social).

3. They Start Early

Premium exits take 3–5 years to engineer. You don’t flip a switch—you build toward it with intention.

So Ask Yourself This:

If you had to sell in the next 12 months, are you truly ready?

Would you get top dollar—or take a haircut on what you get?

Would the business survive without you?

If the answer is no…

Good. That means it’s time to do something about it.

Here’s Your Next Move:

Take the Value Gap Assessment.

It shows you exactly where you stand—and how much you’re missing out on today if your business was best-in-class.

What’s your business worth today?

Where are the risk gaps?

What will buyers see as red flags?

(Click here to take the FREE Value Gap Assessment) 👇

Bottom Line:

You don’t get a second shot at a great exit.

And nothing feels worse than realizing you sold too soon, for too little, and with no real plan for what’s next.

The good news?

You don’t have to be one of the 74%.

You can Elevate before you Exit.

And that changes everything.

Coming Next Week:

What Your Business Is Really Worth (And Why It’s Probably Not Enough)

We’re diving into the real math of valuation—and how to multiply it fast.

📥 Make sure you’re subscribed so you don’t miss it.